Our Fee Story

Thank you for visiting this sub-page and wanting to learn more about our subscription fee simulation. We believe that this is an important component that potential customers must understand in a bid to have a smooth working relation going forward.

A brief note, our fee simulation is inspired by Warren Buffett Partnership’s fee structure with core tenets below:

Investing for the Long Term

We focus on investing with a sound investment framework for long term value creation instead of trading unnecessarily and trying to time the market.

Incentive Alignment

We obtain value by putting our clients first and only incur charges when our clients get their investment value accordingly.

For more information, visit https://blog.recompound.id/p/the-story-of-recompounds-performance

Fee Structure

Important: Note that all funds remain with your account under your name. We have no access nor control to your brokerage account. You execute the investments yourself upon reviewing investment information that is shared from our team.

We only help you with the monitoring of your portfolio value overtime and incur charges accordingly based on your portfolio value.

Huray! you have just started hiring your CIO that will help you invest more intelligently for the long term!

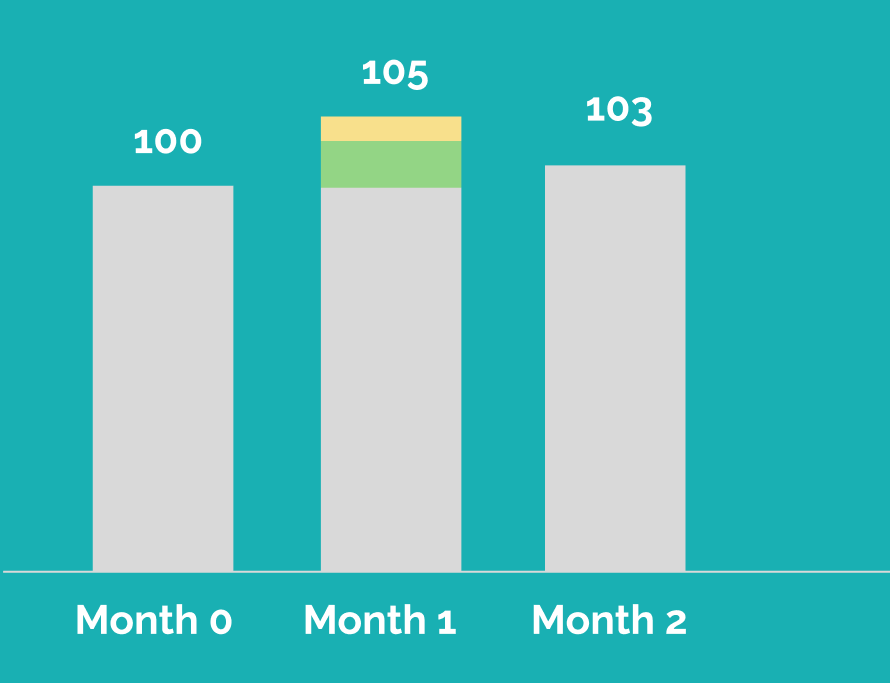

Your starting portfolio value is 100 (invested amount + cash)

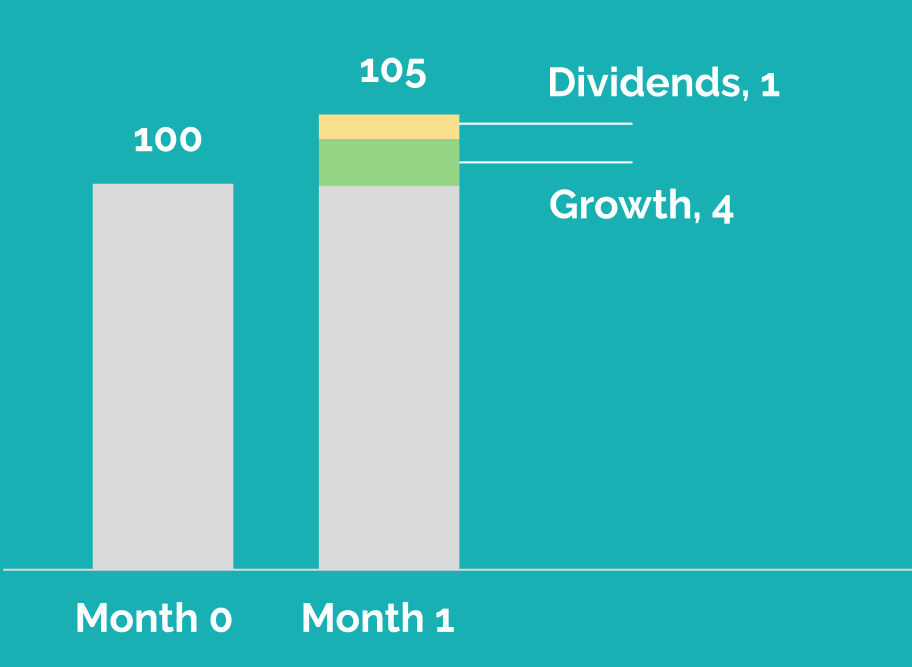

End of month 1: off to a fantastic start! At the end of month 1, we record that your portfolio value (invested amount + cash + dividends) is now 105.

Therefore, your fee will be: (105 - 100) * 20% = 5 * 20% =1

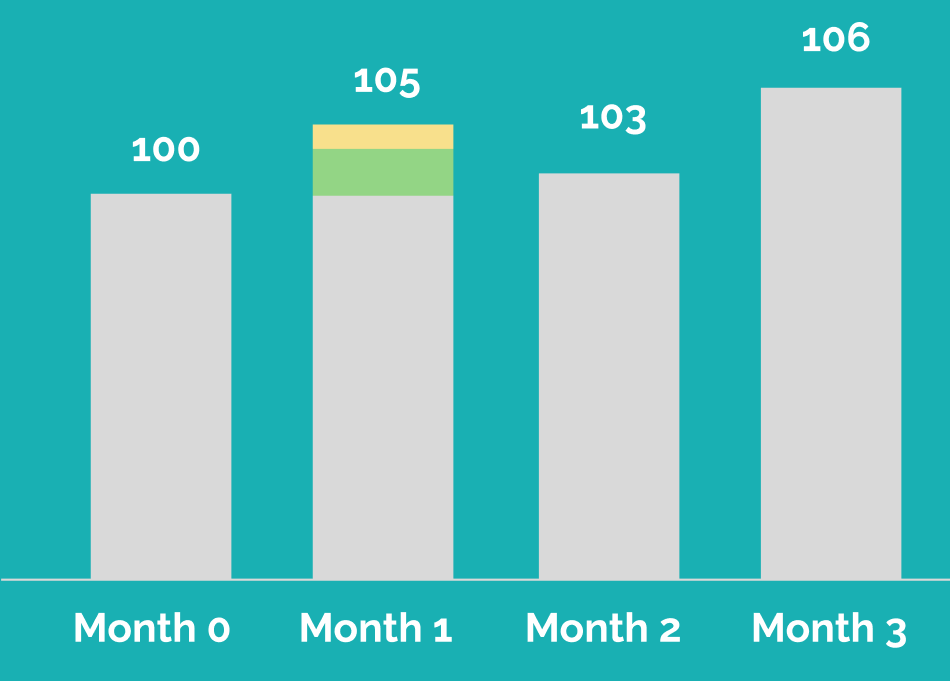

End of month 2: market drawdowns is inevitable. As 103 is less than your all time high value, there is no fee for month 2.

End of month 3: Your previous all time high is 105. Your portfolio value is now 106. Phew recovery!

Therefore, your fee will be: (106 - 105) * 20% = 1 * 20% = 0.2

Small note: not (106 - 103) * 20% because we charge your growth once

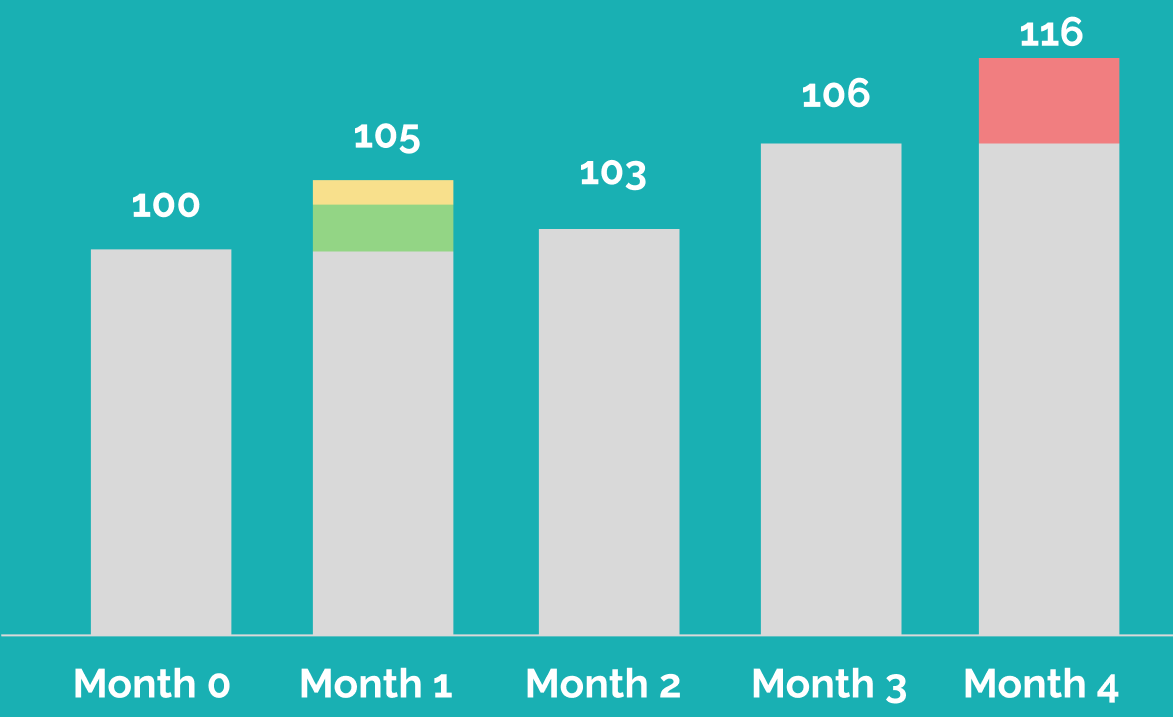

End of month 4:

You decide to topup 10 because you like our working arrangement. Your all time high value is now 116.

Super grateful but there is no fee because portfolio value needs to grow beyond 116.

That’s all! Still burning with questions?

Read our prospectus document, visit: https://bit.ly/RecompoundClientProspectus

Or

Schedule a call with us! We’d be happy to learn answer any questions you'd have for us.

ID

ID